$1000 Trump Stimulus Check: If you’ve been scrolling through your feed and seeing talk about a $1000 Trump Stimulus Check in 2026, you’re not alone. Thousands of Americans are curious, cautious, and maybe even hopeful that another round of federal payments might be headed their way. But before we start dreaming of a fresh deposit hitting our bank accounts, let’s take a clear, factual look at what’s going on — what’s real, what’s just talk, and what you should know to protect yourself and your family. This article is your complete guide to understanding the 2026 stimulus buzz, written in simple, straight talk. Whether you’re a working parent, small business owner, or high schooler trying to understand how money moves through government policy — we’ve got you.

Table of Contents

$1000 Trump Stimulus Check

Let’s bring it home: As of now, there’s no $1000 check being mailed to all Americans. But there is a real, approved program that gives children a financial boost — and that’s a big deal for families planning ahead. The Trump Account is a step toward building economic security for the next generation. The tariff dividend is an idea that could happen — but hasn’t happened yet. And as always, when money is on the table, stay sharp, stay informed, and stay scam-safe.

| Topic | Status / Key Facts |

|---|---|

| New $1000 Federal Stimulus Check (Adults) | Not approved by Congress — No payments scheduled. |

| $2000 Tariff Dividend Idea (Adults) | Proposal only — Not law, must be approved by Congress. |

| $1000 “Trump Account” for Kids | Official program — one‑time federal contribution for eligible kids born 2025–2028. |

| Timing of Trump Account Contributions | Accounts open July 4, 2026; contribution after. |

| Military “Warrior Dividend” | One‑time, tax‑free payment to ~1.45 M service members. |

What’s Really Happening With the $1000 Trump Stimulus Check Talk?

First things first: There is no approved $1000 federal stimulus check for all adults in 2026.

That’s the fact.

A lot of the buzz you might be hearing is either political speculation or social media misinformation. Some folks are mistaking older pandemic-era stimulus checks for new proposals. Others are confusing policy ideas — like the tariff dividend — with actual laws.

So let’s break it down.

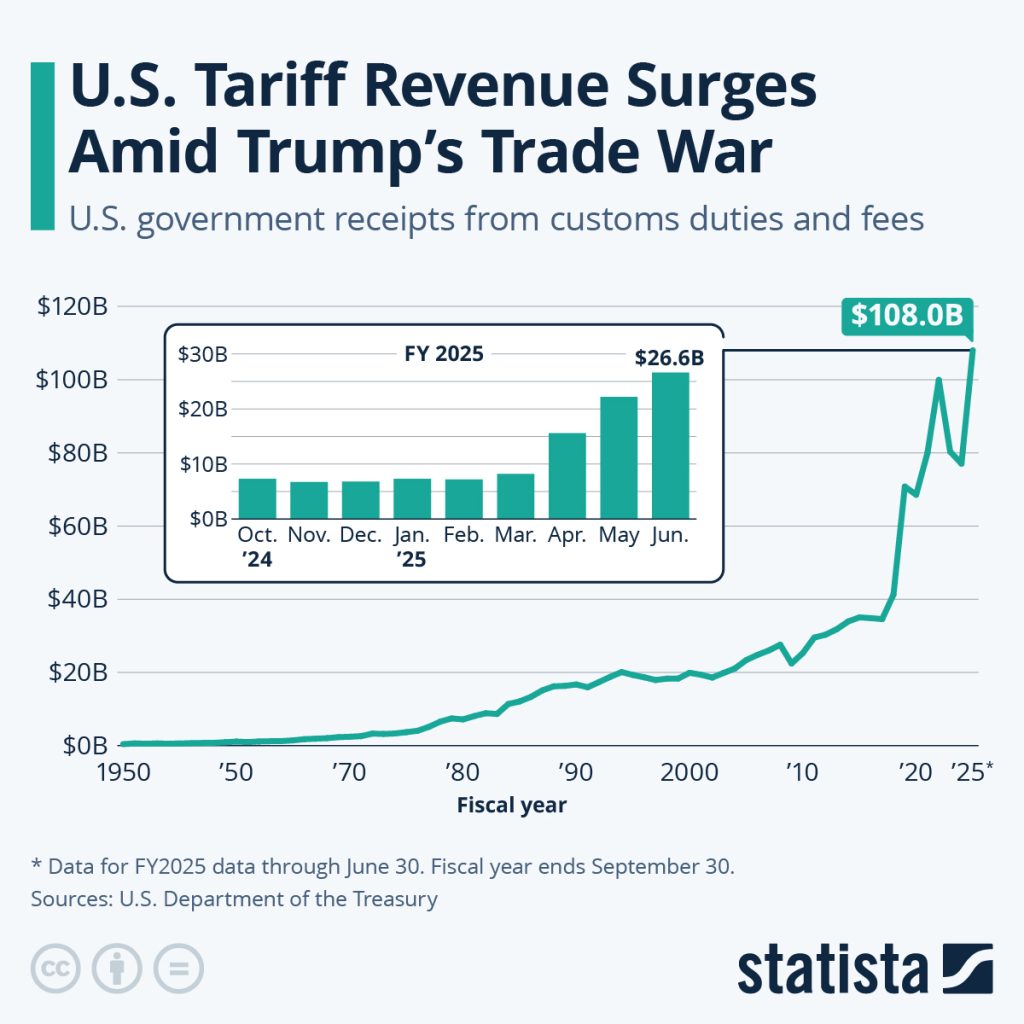

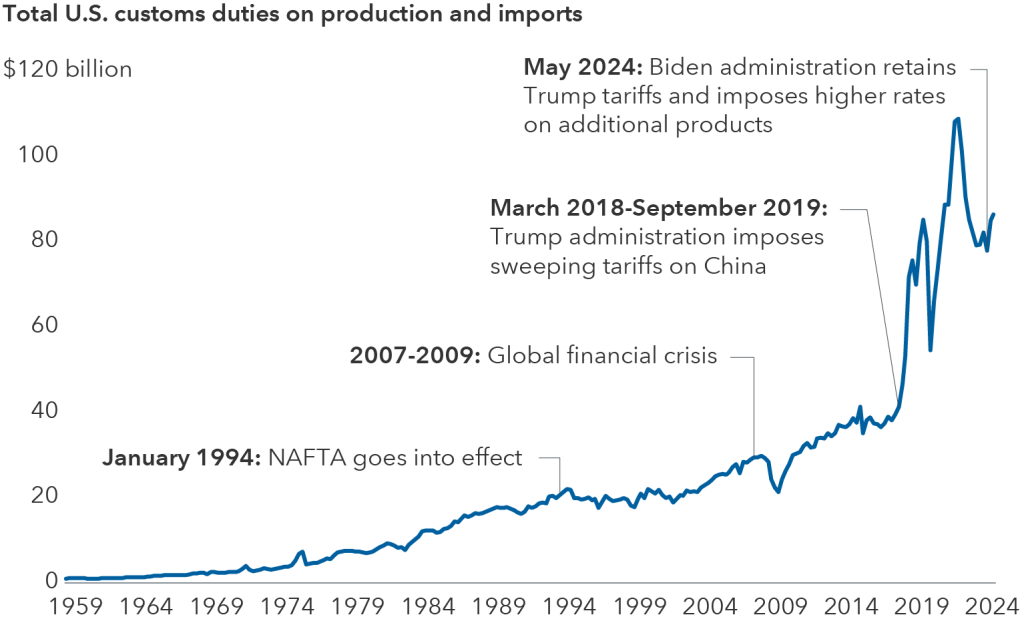

Understanding the Tariff Dividend Idea

In campaign speeches and interviews, former President Donald Trump has suggested that Americans could receive $2000 “tariff dividend checks” funded by import tariffs — the taxes the U.S. charges foreign countries to bring goods into the country.

On the surface, it sounds simple: the government collects tariff money and gives it back to Americans.

But here’s the reality:

- It’s not an official program. No law has been passed.

- It would require a full act of Congress to approve and fund such payments.

- According to nonpartisan economic experts, the revenue from tariffs isn’t enough to support such a massive payment to every American.

A report from policy analysts estimated that such a program could cost hundreds of billions, depending on how many people qualify and how much is paid. As of early 2026, no official budget includes these payments.

That doesn’t mean it’s impossible — but it’s far from guaranteed. And even if it does become a reality, the process would likely take months, maybe years, before any check is cut.

What Are Trump Accounts? (And Why They’re Real)

Now let’s shift from speculation to something that’s 100% real and signed into law — the Trump Accounts.

These aren’t stimulus checks in the traditional sense. You won’t find $1000 direct-deposited into your checking account. Instead, they are federally backed investment accounts designed to give children born between 2025 and 2028 a financial head start in life.

Here’s how it works:

The Basics

- Each eligible child will receive a one-time $1000 federal seed contribution into their Trump Account.

- The account functions like a Roth IRA or 529 plan, but with unique features.

- The funds are invested, typically in low-cost U.S. stock index funds, and allowed to grow tax-deferred.

This program was created under the One Big Beautiful Bill Act, signed into law in 2025. Unlike campaign promises or temporary stimulus checks, this program is permanent (for now) and legally binding — unless repealed by future legislation.

Eligibility Requirements

To qualify for the $1000 deposit:

- The child must be born between January 1, 2025, and December 31, 2028.

- They must have a valid Social Security number.

- A Trump Account must be opened for the child by a parent or guardian, starting July 4, 2026.

There are no income restrictions for families. Whether you make $30K or $300K a year, your child qualifies if they meet the birth window and documentation rules.

Extra Features

- Parents, grandparents, and even employers can contribute additional funds to these accounts each year.

- Contributions are not taxed as income.

- The money can be used later in life for college, first-time home purchase, or retirement.

- If untouched, the funds grow through compound interest, potentially turning that $1000 into several thousand dollars by adulthood.

It’s not fast money — but it’s a smart long-term tool for building generational wealth.

How Does This Compare to Past Stimulus Payments?

Let’s not forget the big pandemic-era stimulus payments of 2020, 2021, and 2022. Those were:

- Direct-to-bank payments (via IRS or paper check).

- Based on income eligibility — typically individuals earning under $75,000 or households under $150,000 got the full amount.

- One-time or multi-round payments ($1200, $600, $1400, etc.)

The current $1000 Trump Account contribution is not the same kind of payout. It’s:

- Only for children born in a specific timeframe.

- Not cash in hand, but an investment account.

- Not subject to income caps.

So if you’re hoping for a direct $1000 check for yourself in 2026 — it’s simply not happening (yet).

The Warrior Dividend — A Real Payment for Military Personnel

One group that has received a real cash payout is active-duty military service members.

In December 2025, the federal government issued a one-time tax-free payment of $1,776 to each eligible active-duty member of the military. This was part of a larger package to celebrate America’s 250th anniversary and recognize military service.

Roughly 1.45 million people received this payout.

While it’s unrelated to the stimulus or Trump Account discussions, it’s worth mentioning because it shows how targeted federal cash benefits are still very much a thing — just not for the general population.

What About Scams and Misinformation?

Let’s be real — whenever “free money” is trending online, scammers start circling like sharks.

If you’ve received an email, text message, or social media post claiming that:

- You’re “pre-approved” for a $1000 government check

- You just need to click a link and verify your banking info

- You owe a fee to release your federal payment

IT’S A SCAM.

The IRS and U.S. Treasury do not send payments this way. They never ask for sensitive information via email or text, and they don’t charge you to “claim” your payment.

If in doubt, always visit official government websites directly. Never click unsolicited links or download shady attachments.

What You Can Do Right Now About $1000 Trump Stimulus Check?

Even though there’s no general stimulus check available, you can still make smart moves:

1. Parents — Prepare for Trump Accounts

If you have a child born in 2025 or later:

- Keep their Social Security number handy

- Be ready to open a Trump Account on or after July 4, 2026

- Look out for IRS Form 4547, which is expected to be required to initiate the account

2. Stay Informed on Legislation

Any future stimulus, rebate, or dividend payment will require new legislation. It’s worth keeping up with trusted news sources and federal announcements so you don’t miss anything real.

3. Avoid the Noise

Ignore viral videos and clickbait headlines promising checks “coming tomorrow.” Real programs take time — and they’re announced through official channels, not random TikToks.

Social Security Abroad Rules – Countries Where Payments Are Restricted in 2026

Social Security Stimulus Payment 2026 – First COLA-Adjusted Payment Date and Who Qualifies

Tariff Dividend Payments January 2026 – Reality Check on New Federal Payment Claims